Each year, fall seems to come and go in the blink of an eye. It can feel like it goes from cool evenings and a faint smell of pumpkin spice to snow days and slippery sidewalks before you even have time to put on a toque. When it comes to your home, taking a little time to get prepared in the warmer weather could save you some headaches when winter starts blowing in. Wondering what kind of home maintenance tasks you need to do to get your property ready for fall and winter? Consider these tips:

Steers Blogging Team

Recent Posts

The ultimate fall home maintenance checklist

What to do if another driver exhibits signs of road rage

Dealing with another driver's road rage can be incredibly stressful and scary, and it can even lead to dangerous driving situations or accidents. Road rage, or aggressive driving, can include erratic driving behaviours like tailgating, yelling, persistent honking, blocking traffic, or even following another driver too closely to intimidate them. Whatever form it takes, road rage can increase the risk of an accident, so it's always better to avoid these situations.

Topics: Auto Insurance

Why some small business owners don’t have insurance

It’s no secret that climate change is leading to more frequent and more severe weather events and catastrophes around the world. Here in Canada, some of the most obvious examples include an increase in wildfires, more extreme heatwaves, and flooding. Consider these tips to make sure you’re prepared to protect your home in case of a major weather event in your neighbourhood.

What information do I need to provide when making a home insurance claim?

Dealing with an emergency at home is never easy, whether it’s a fire, break-in, or flood. Thankfully, your home insurance policy is there to protect you and your family when you need it most. Keeping track of some important information before, during, and after an incident can make for a smoother claims process and help you feel at home again as quickly as possible.

Topics: Home Insurance, Home Inventory Checklist

When the unexpected happens, many people debate whether or not they should make a home insurance claim. Maybe they’re worried about losing their claims-free discount, risking a denied claim, or waiting too long for their insurance company’s contractor to complete repairs. But remember, the whole point of home insurance is to protect you when you need it most — the last thing you should be worried about is whether or not you should make a claim. So, if you ever find yourself debating “to claim or not to claim,” ask yourself these three questions.

Hurricane season is underway. Here are some simple steps you can take before, during, and after a hurricane to protect your space and keep your family safe all season long.

10 things you should have in your car when you’re taking a road trip

The sun is shining, the weekend is here, and you're itching to head out on the open road. Road trips are full of unplanned adventures: some good, some not so good. Beyond the essentials that should always be in your car (like a first aid kit, booster cables, a spare tire, your vehicle's registration, proof of insurance, phone and charger), here are 10 things to keep in your car so you're prepared for anything a road trip might throw at you.

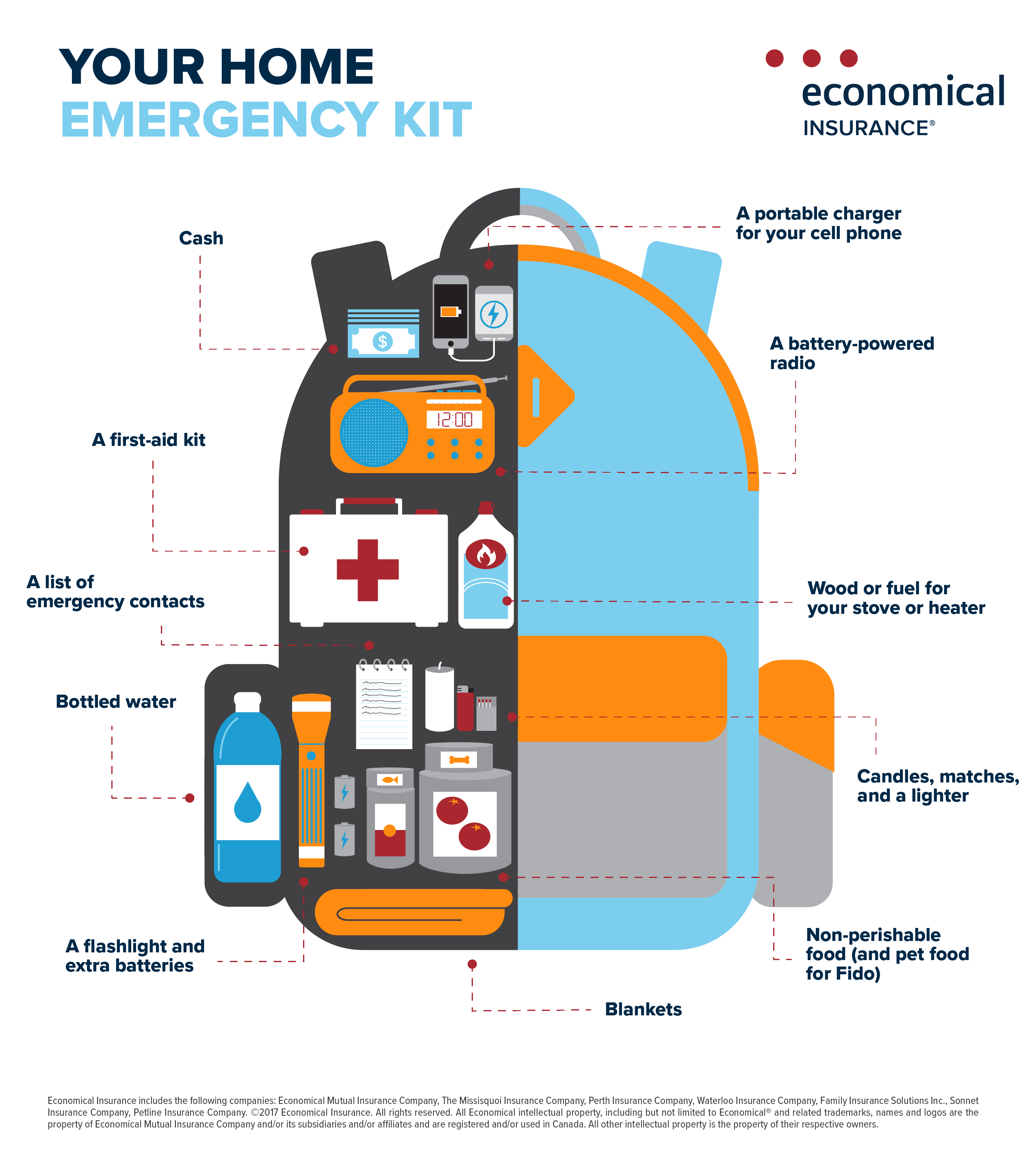

When creating an emergency survival kit for the home, consider the supplies you might need to last you and your family for a minimum of three to seven days. In case of emergencies that may require that you leave your home quickly, such as a wildfire, prepare your kit well in advance, and keep it in an easily accessible location so you can take essential items with you if you must evacuate with little notice.

;

;

;

;

;

;

;

;

;

;

;

;

;

;