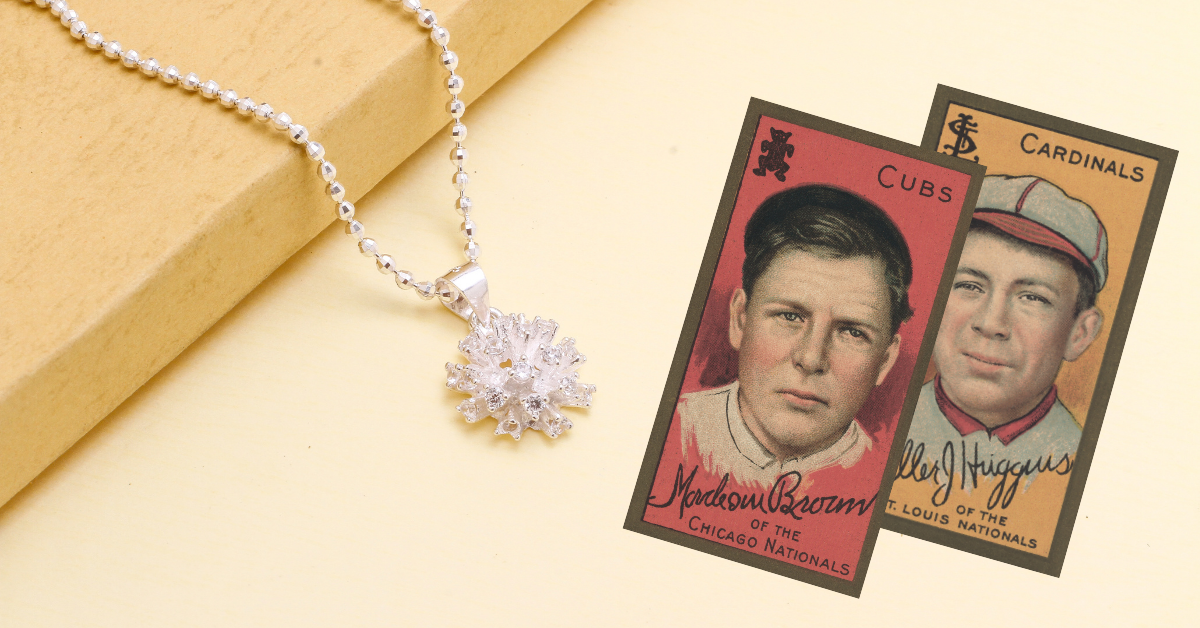

While the socks you received for Christmas may not require additional home insurance, any sports memorabilia, high-end jewelry, collector comic books or big-ticket items probably do.

While the socks you received for Christmas may not require additional home insurance, any sports memorabilia, high-end jewelry, collector comic books or big-ticket items probably do.

As stated in this Economical article, “Most home insurance policies outline specific limits for different kinds of specialty items, and you might be surprised to find out how quickly your belongings can exceed these limits. If your belongings in any given category add up to an amount that goes beyond the limit, it’s best to purchase extra coverage to make sure you have the protection you need."

How to protect your big-ticket Christmas gifts.

If you unwrapped an item of value this holiday season take note of the list below. Making sure you have everything required for your insurance policy, can help to ensure your items are fully covered incase of theft, fire or other circumstance.

- Photos – similar to taking a home inventory, take pictures of your valuable items and ensure they are safely stored in case you need the photos for a claim. In the event that your valuable item is lost or stolen, photos can help assist with the ease of the claims process.

- Update your home inventory – always keep your home inventory up to date and include a detailed record for each of your valuables.

- Appraisals - to find out the true value of your collectable or antique, you might need to have it appraised. Once appraised, you will want to safely store the appraiser’s report. In addition to a broker requesting to see the appraisal at the time of a claim, some insurers require appraisals before adding extra coverage on items such as jewelry, furs, sports collections etc.

- Receipt – if you need to make an insurance claim for an item that didn’t require an appraisal when you added it to your policy, it helps to have proof of how much it cost at the time of purchase. Although it might be awkward to ask the gift-giver for, if you tell them that you need the receipt for insurance purposes, they’ll probably understand.

- Policy limits – once you’ve recorded your new stuff in your home inventory, add up the total value for each of the specialty categories outlined in your policy and make sure all of your stuff fits within the limits of your coverage.

If you are unsure of whether or not you need insurance for your high-value items, reach out to OTC Insurance to confirm what kind of coverage is available — in some cases, a particular risk, such as theft, may not be included in your current home insurance coverage, and the way your claims are paid may be different , so it’s best to double-check.

;

;

;

;

;

;

;

;

;

;

;

;

;

;