Do you plan on inviting friends and family over during the holidays?

Does your home insurance cover large gatherings during a pandemic?

Topics: Home Insurance

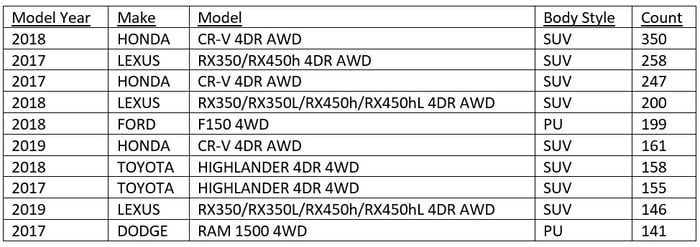

Is your vehicle in the list of the top 10 most stolen vehicles?

Have you checked to see if your vehicle is one of Canada’s most stolen? The Insurance Bureau of Canada (IBC) recently compiled 2020’s list of the top 10 stolen vehicles across Canada. Once again thieves have targeted high-end vehicles, including SUVS and off-road capable vehicles, and, unfortunately, the pandemic has led to an increase in vehicle thefts.

Topics: Auto Insurance

The Risks of Not Keeping Your Business Free of Snow and Ice

Nova Scotia law makes it clear: all business owners must ensure their property is reasonably safe for visitors. Failing to do so can result in visitors and employees suffering sprains, strains, broken bones, and more from incidents like slip and fall accidents.

Closing your cottage for the winter: A guide

Topics: Home Insurance

Safety tips for outdoor patio heaters and fire elements

Topics: Home Insurance

Summer has ended and the days are getting cooler and you know what that means – it’s almost time to close your seasonal cottage or prepare your manufactured home for the winter.

Topics: Home Insurance, About OTC Insurance

Protecting yourself against tow truck fraud

Earlier this year, the Ontario government announced they are creating a task force to regulate the towing industry to help vulnerable drivers who are being taken advantage of by fraudulent tow truck drivers, repair shops and rental companies.

Topics: Auto Insurance

Preventing water damage during construction

Water damage to a business, regardless of how it happens, can lead to mold growth, costly litigation and financial loss. In addition to direct costs associated with cleanup, material replacement, equipment repair and mold remediation, water damage incidents may lead to significant indirect costs associated with construction delays and business interruptions.

Topics: Commercial Insurance, Overland Flood Insurance, Commercial Property Insurance

;

;

;

;

;

;

;

;

;

;

;

;

;

;